Risk Management

We conduct risk management in four dimensions: quality, environment, food safety, and occupational health and safety.

Risk Management

We conduct risk management in four dimensions: quality, environment, food safety, and occupational health and safety.

Purpose of Risk Management

To enhance corporate governance, mitigate risks with potential impacts on our operations, and achieve business stability and sustainable development, we conduct risk management in four dimensions: quality, environment, food safety, and occupational health and safety. Risk management has the following goals:

01 / Ensure the effectiveness of management system policy and objective implementation

02 / Amplified positive effects Ongoing improvements (Opportunities)

03 / Mitigation of negative impacts (Risks)

04 / Ongoing improvements

| Dimension | Quality | Food Safety | Environment | Occupational Health and Safety |

|---|---|---|---|---|

| Targets and Policies | Quality, safety, and customer satisfaction first | Quality, safety, and customer satisfaction first | Energy conservation, environmental protection, and cherishing our planet | Care for employee physical and mental well–being |

Risk Management Process

Each unit conducts annual risk identification and assessment for each system and formulates contingency strategies and corrective measures based on stakeholder grievance (reporting)/feedback channels by Management Procedures for Data Analysis and Ongoing Improvements and Management Regulations for Hazard Identification and Risk Assessment.

| Management system | Quality | Food safety | Environment | Occupational Health and Safety |

|---|---|---|---|---|

| Procedures | Data Analysis and Continuous Improvement Management Procedure | Hazard Identification and Risk Assessment Management Measures | ||

| Risk assessment units | All departments of the Company | |||

| Grievance mechanism / communication channels | • Feedback to Sales Unit • Internal Abnormality Report • Real–time Verbal Communication • Meetings |

• Internal Abnormality Report • Real–time Verbal Communication |

• Feedback to the Health & Safety Management Department • Real–time Verbal Communication • Occupational Health and Safety Committee Meeting |

|

Risk Management Policy

| Risk items | Risk scenarios | Risk management strategy (contingency measures) |

|---|---|---|

| Occupational Hazards |

|

|

| Product Safety |

|

|

| Continued increase of GHG emissions |

|

|

| Labor shortage |

|

|

Audit Mechanism

To ensure the continued and effective implementation of the Company’s various management systems and to identify and correct issues in a timely manner, we have established the “Internal Audit Management Procedure.” Internal and external audits are conducted regularly to maintain the effectiveness and continual improvement of our ISO systems and relevant certifications. In 2024, third–party certification bodies conducted external audits across all systems, and no major non–conformities were issued. All certifications remain valid.

Internal audit process

Step. 1

Annual internal audit plan

Step. 2

Formation of an audit task force

Step. 3

Pre-audit meeting

Step. 4

Issuance of audit notice

Step. 5

Execution of audit operations

Step. 6

Issuance of a non-conformity report

Step. 7

Completion of the audit summary report

Step. 8

Management review meeting (quality/environment/food safety management system)

Occupational Health and Safety Committee Meeting (Occupational health and safety management system)

The Management and Adaptation of Climate Change Risks

In recent years, extreme weather has become increasingly frequent, highlighting the urgent threat of global warming. Governments worldwide have placed growing emphasis on climate change, strengthening national and regional regulations to ensure that companies incorporate climate risks into business management. In addition to identifying the operational risks posed by climate change, KYF has adopted the recommendations of the Financial Stability Board’s Task Force on Climate–Related Financial Disclosures (TCFD). The four core pillars—Governance, Strategy, Risk Management, and Metrics & Targets—have been integrated into our management practices, and performance in these areas is disclosed in our sustainability report. This enables stakeholders to better understand the impacts of climate–related risks and opportunities, as well as KYF’s corresponding response strategies.

As there have been no significant changes over the past two years, the risk and opportunity assessment from 2022 has been retained.

01 Governance / Governance of Risks and Opportunities

The General Manager serves as Chair of climate–related risk and opportunity governance. The Sustainability Section initiates discussions, identification, and assessment at ESG Committee meetings. Climate–related decisions are submitted to the Board of Directors for approval.

02 Strategy / Business and Financial Strategic Planning (Actual and Potential)

- Refer to the 2022 table of short–, medium–, and long–term climate risks and opportunities.

- Refer to climate–related impacts.

- We conducted discussions on the 2°C scenario (2DS) during Sustainability Committee meetings, complemented by assessments of physical climate

risk scenarios using tools provided by the Taiwan Climate Change Projection and Information Platform (TCCIP). We ultimately selected the 2DS/RCP2.6 scenario as the basis for assessing our physical climate risks. Under this scenario, we describe climate–related risks and opportunities, focusing on physical risks and regulatory transition risks.

03 Risk Management / Climate-related risk management process

Risk identification, assessment, and management process (see flow chart)

04 Metrics & Targets / Metrics and Targets for Climate–related issues

- rPET sales ratio reached 21.15% in 2024.

- Annual electricity saving rate of 1%; total savings in 2024 reached 2,401,441 kWh (2.3%), exceeding the 1% target of 987,901 kWh based on 2024

electricity consumption. - Active promotion of improvement initiatives, including energy conservation, waste reduction, and production processes, along with the enhancement

of the improvement proposal system. In 2024, a total of 74 proposals were submitted, comprising 30 energy conservation initiatives and 8 waste

reduction projects. - The recycling rate of regrind material on production lines reached 47.58%.

- Completed 2024 GHG inventory with third–party verification.

Scope 1 emissions: 988.7110 tCO2e ;

Scope 2 emissions: 44,583.8433 tCO2e ;

Scope 3 emissions: 197,036.1529 tCO2e ; - The renewable electricity usage rate reached 7.8% in 2024.

Governance

Climate change–related discussions and management are carried out by the ESG Committee, with relevant resolutions submitted to and approved by the Board of Directors. The Committee is supported by working groups coordinated by the Sustainability Section. An annual report on climate governance in line with the TCFD framework is submitted to the Board as a reference for decision–making.

Strategy

To address climate–related risks and opportunities impacting the Company’s strategic and financial planning, the Company references the TCFD climate scenario framework and applies both quantitative and qualitative climate scenario analysis to

support corresponding strategies. The 2°C scenario (2DS) was discussed at ESG Committee meetings, using tools provided by the Taiwan Climate Change Projection and Information Platform (TCCIP) to assess physical climate risk scenarios. As a result, the 2DS / RCP2.6 scenario was selected as the Company’s physical climate risk scenario, under which risks and opportunities related to physical and regulatory transition risks are identified and described.

Climate–related risks and opportunities relevant to the Company’s operations were ultimately identified with reference to TCFD disclosures in the manufacturing sector. For long–term business planning (defined as one decade), the Company categorizes

time horizons as follows: short–term: 1–3 years; medium-term: 3–5 years; long-term: 6–10 years.

Risk management

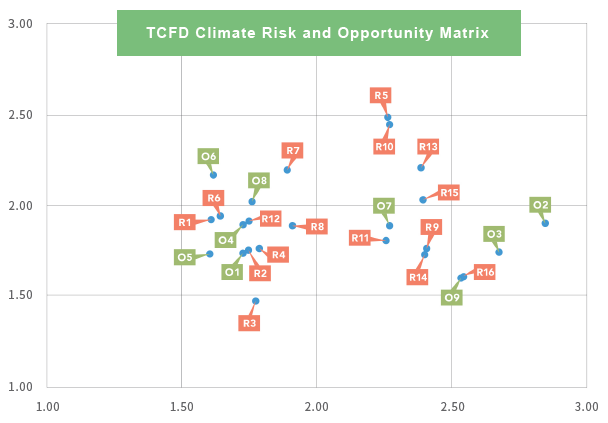

On January 18, 2023, KYF convened a TCFD Climate–Related Financial Disclosure Discussion Meeting through the ESG Committee to discuss climate change impacts and opportunities with committee members across departments. The discussion was structured according to TCFD recommendations, focusing on transition risks (policy and regulation, technology, market, reputation), physical risks (acute and chronic), and opportunities (resource efficiency, energy sources, products/ services, markets, and resilience).

TCFD Risk Management Process

Step. 1

Climate and environmental data collection completed by the ESG Committee, along with assessment of climate risks and operational scope.

Step. 2

Compilation of a climate–related risk and opportunity inventory

Development of an internal operational impact survey questionnaire

Step. 3

The ESG Committee conducts analysis of climate–related risks,

opportunities, and operational impacts, and determines material risk items.

Step. 4

Development of implementation strategies and target setting

Step. 5

Annual rolling review of the effectiveness of implementation strategies and targets by the ESG Committee

Climate–Related Risks and Financial Impacts

| Category | Risk | Description | Financial Impact |

|---|---|---|---|

| Transition Risks | Substitution of existing products and services with lower emissions options | Because the use, promotion, or development of low–carbon products is reflected directly in rising supply chain costs and raw material prices, these two dimensions are inextricably intertwined and mutually interrelated. | Increased low–carbon product costs. |

| Increased cost of raw materials | Decreased demand for products and services. | ||

| Physical Risks | Increased severity of typhoons, floods, and other extreme weather events | Smooth operations of the response mechanism are maintained through scrutiny of weather patterns and regular organization of emergency drills and training. Patrols are conducted and relevant reporting mechanisms are activated when special weather reports are received. | Impact on workforce management and planning, and decline in production capacity. |

| Resource Efficiency Opportunity | Use of more efficient production and distribution processes | 1. We have already adopted proposals for efficiency improvements and convened quarterly ESG Committee meetings to implement tracking and reduce energy consumption through the use of high–efficiency equipment.

2. Use of self–generated renewable energy. 3. Scrutiny of freight forwarder conditions and selection of low–carbon transportation methods. |

Increase capacity and revenue; lower operating costs. |

Metrics and targets

Based on TCFD climate–related risks and opportunities, the Company has established corresponding metrics and targets:

- rPET sales ratio reached 21.15% in 2024.

- Annual electricity saving rate of 1%; total savings in 2024 reached

2,401,441 kWh (2.3%), exceeding the 1% target of 987,901 kWh based on 2024 electricity consumption. - Active promotion of improvement initiatives, including energy conservation,

waste reduction, and production processes, along with the enhancement of the improvement proposal system. In 2024, a total of 74 proposals were submitted, comprising 30 energy conservation initiatives and 8 waste reduction projects. - The recycling rate of regrind material on production lines reached 47.58%.

- Completed 2024 GHG inventory with third–party verification.

Scope 1 emissions: 988.7110 tCO2e ;

Scope 1 emissions: 44,583.8433 tCO2e ;

Scope 1 emissions: 197,036.1529 tCO2e ; - The renewable electricity usage rate reached 7.8% in 2024.